Morgan Stanley's single-family office advisory group and Botoff Consulting published their annual compensation report Thursday, and it was full of firsts.

Like previous editions, the 2025 report extends more than 40 pages and is based on a survey with hundreds of participants. Through June, July and August last year, the organization surveyed 433 U.S. firms (single-family offices, family investment firms and private trust companies), which shared data on 2,208 incumbents.

Offices are usually holistic; they manage investments and other financial matters, advise beneficiaries on their wealth, and are responsible for a wide range of lifestyle and personal services. This year’s report aimed to categorize offices based on their activities, enabling them to benchmark themselves more accurately.

Unlike past editions, the 2025 compensation report includes data specifically about investment-focused offices, yielding more granular insights.

Investment-focused single-family offices are more reliant on long-term incentive plans, with 62% using them compared to 54% of all single-family offices. The survey also found that 76% of firms with long-term incentive plans offered employees some type of bonus or reward to encourage participation. (Almost all offices, or 90%, said their employees are eligible for annual incentive or bonus plans.)

Valerie Wong Fountain, a managing director and the head of family office resources platform and partner management at Morgan Stanley, wasn’t surprised that investment-focused offices were more reliant on those incentives.

“We would expect to see that with the increased professionalization of family offices. And the reason why you would see more long-term incentive plans within investment-focused family offices is that, generally, those are tied to the investment activity of the family office,” Wong Fountain told Modus. The plans are a way to “appropriately align the key management staff who are involved with investment decision making and oversight of the portfolio with the family's mission and objectives.”

For the first time since the organizations began collecting information about long-term incentive plans in 2015, co-investment opportunity was a more popular plan type (57%) than deferred incentive compensation (56%).

“Family offices in general have expressed an increased interest and focus on private investments. If you keep that in the back of your mind, then the co-investment opportunity becomes a very interesting long-term incentive to put in place. It can be very powerful, especially paired with leverage through recourse loans as well,” Wong Fountain said.

Co-investments, which for employees could mean opportunities to invest in a company alongside the family office and a general partner, or alongside the office in one of its direct investments, give workers some skin in the game. Office employees — even experienced investment staff who might be wealthy themselves — probably would not get the same deal opportunities or terms on their own. They also get to lean on the knowledge, resources and due diligence of the office or a general partner, which wouldn’t be available to them otherwise.

Offices are also willing to make those deals even sweeter for employees by offering them leverage, like private-equity firms do for their employees.

“The co-investment opportunity in itself drives very strong alignment and therefore should also drive performance and results. Also, from the employee perspective, it provides additional wealth creation opportunities for them within the family office,” Wong Fountain said.

The 2025 report was also the first one to ask respondents about both their total operating cost and compensation cost as a percentage of assets under management. Respondents asked about that breakdown in the past, so Morgan Stanley and Botoff included it this time around.

Eighty-nine percent of investment-focused firms reported a total operating cost of 1.9% or less, with 53% of these firms operating at a cost of 1% or less. That means, for example, if an office manages $100 million in assets, its annual operating cost is typically less than $2 million, and often less than $1 million. And the majority of those expenses are on compensation. Out of the same group, 95% reported compensation cost as a percentage of AUM of 1.9% or less, with 55% below 0.5%.

“We've always known that the compensation and personnel cost is a significant portion of the operating cost of the family office, and this quantifies it here. But I think this is a helpful benchmark for families,” Wong Fountain said.

“If I think about insourcing, outsourcing, or a combination of both, ‘Where do I fall based on my AUM, and am I doing this in an efficient way, and am I receiving the quality of services that I should expect from my family office?’”

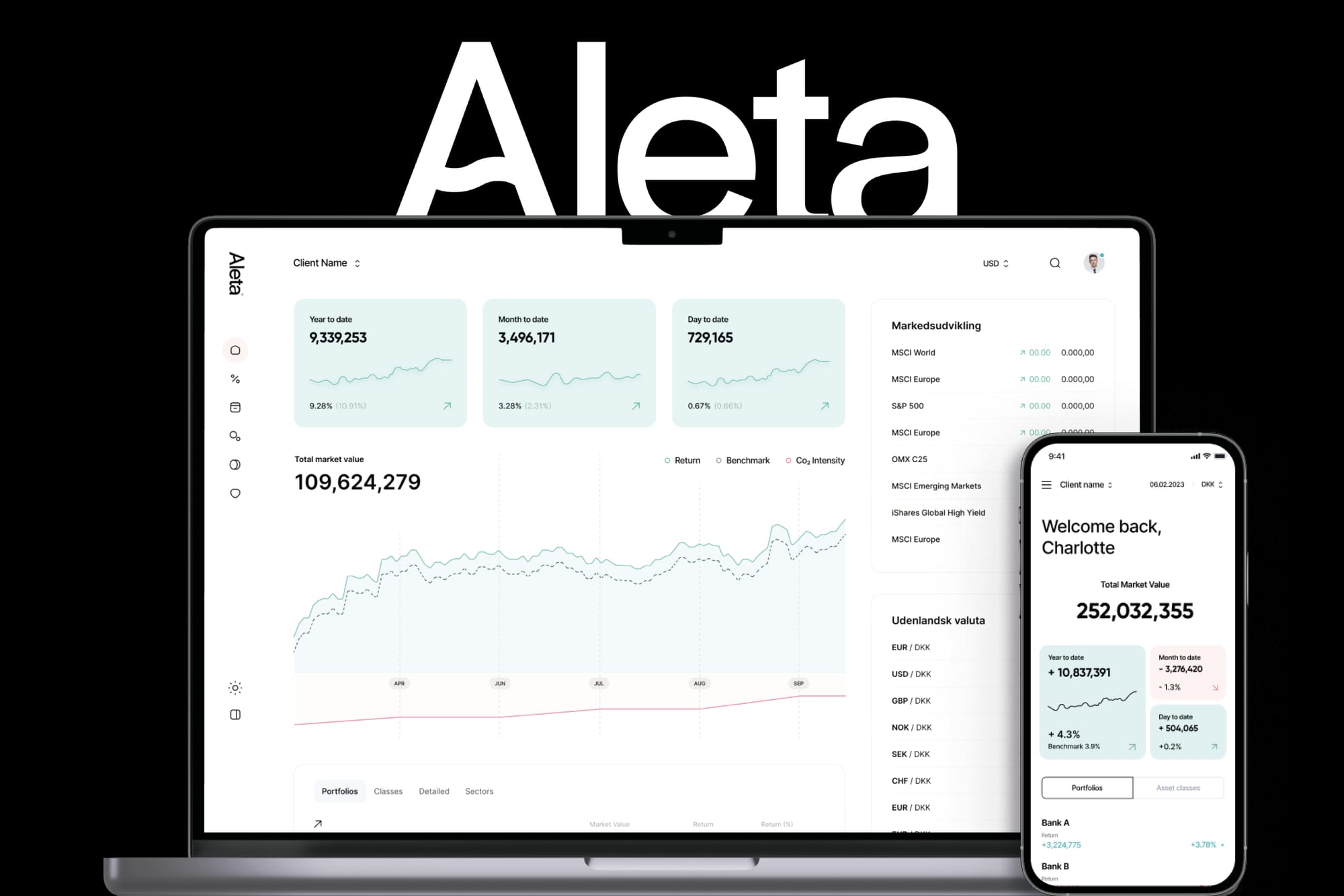

Move beyond Excel spreadsheets with next-generation family office software

Only 26% of family offices report using leading-edge software solutions.

Are you one of them?

Aleta replaces Excel spreadsheets and fragmented legacy tools with intuitive dashboards, AI-powered analytics, and professional-grade wealth reporting.

Learn more about Aleta's platform, start a free trial, or discover our insights in our most-downloaded private-equity ebook.

More News

- Last week, Modus wrote about whether family offices would begin asking employees to put their loyalty in writing. If you want employees to be happy, perhaps consider offering them multimillion-dollar mortgages, like magazines used to do.

- Zara Founder’s Deal Spree Shields His $104 Billion From Tax.

- The Worst Performer in Billionaires’ Portfolios? Trophy Art.

- A Family Feud Is Rocking One of the World’s Richest Hotel Dynasties.

- Tom Taylor is the new CEO and president of the Bezos Earth Fund, the organization that manages a $10 billion commitment from Jeff Bezos to fight climate change and other negative impacts humans have on nature. He retired from Amazon in 2023 after 22 years at the company, where he held leadership positions related to global operations, e-commerce, and artificial intelligence.

- Lavish Spending and Weak Growth Engulf Billionaire-Backed AI Startup SandboxAQ.

- The Fashion Must-Have at ‘Billionaire Summer Camp’: A Humble Baseball Cap.

- Customers are furious over unofficial quid pro quo sales tactics for the “Blue Dial,” the limited-edition Nautilus 5711 that Patek Philippe and Tiffany collaborated on. Unless a customer already had a long receipt coming their way, the $52,635 watch wasn’t made available for them to purchase. “With rich people, if you tell them they can’t have something — they want it. It’s called the psychology of billionaires.”

- A masterclass in handling failure.

Jobs

- Trader-turned-recruiter Brett Finer is helping a New York-based family office in urgent need of an administrative assistant. The person will greet guests at the office in SoHo, manage calendars and have other usual responsibilities. But they also want someone who can think outside the box and grow professionally within the organization. The 15-person office has an “incredible culture,” and the employees are “nice as people can be.” Salary is up to $150,000.

- Cody Kievlan at Ballmer Group is hiring a senior system analyst to help with the family businesses and Halo Sports & Entertainment.

- StevenDouglas is helping a family office in Los Altos, California, find a senior controller, and another one in Miami find a director of operations.

- Here’s a job posting that sticks out: HyperGrowth, a “next-gen family office holding company designed to outperform sovereign wealth funds and legacy institutions,” is hiring a CEO of family office operations and founder affairs. It does not sound like a low-stress job… “This is not a startup. It’s not a fund. It’s not a lifestyle business. HyperGrowth is a sovereign-scale value-creation platform…aggressively building and investing in 10,000+ touch-points (directly and indirectly) and chasing at least $1T+ in platform value within the next 5–10 years (if not sooner). Our ambition is insane and our pace is blistering.”

Other Stuff

- All the Modus newsletters are online. The archive isn't huge (yet), but there is a search function.

- Wish there was more to read about a family-office topic? Send me an email or use Signal on a personal device not accessible by your employer (for example, a mobile phone or computer disconnected from a company VPN).

- Help Modus reach 1,500 followers on LinkedIn!

I'll be...

- Dining al fresco in NYC, now that it’s not 1,000 degrees (and if it doesn’t rain).

- In Edmonton for the August long weekend.