Programming note: Modus occasionally sends timely emails in addition to, or in place of, the regular Friday newsletter.

Citi Wealth’s 2025 single-family office report, one among a short list of similar reports widely read and referenced, was published this morning.

Like other reports this year from UBS, Morgan Stanley, Goldman Sachs, the Citi report affirmed that most family offices haven’t made significant changes to their strategic asset allocations and the changes they did make reflected their bullish sentiments.

Out of the offices surveyed, 36% planned to increase their private-equity allocations (only 10% planned to decrease theirs), up 10 percentage points from 2024. A third of offices also planned to invest more in public equities.

Almost one-third of offices said they planned to increase their fixed-income allocations, which could be another sign of their bullishness, as offices may be buying longer-duration bonds in anticipation of lower interest rates in the near- and medium-term. Over the next six to 12 months, only 17% and 15% of the surveyed offices said they were bullish about investment-grade and corporate high-yield fixed-income, respectively.

At least some family offices were posting good returns through half the year (assuming these are risk-adjusted and ignoring other factors): A quarter of family-office portfolios were up more than 10% year-to-date when surveyed, and 59% of portfolios were up between 0% and 10%.

Ten percent of family offices said their portfolios were flat, and 4% had a negative return of 0% to 10% midway through the summer. Only 1% of respondents reported that their portfolios were down 10% or more.

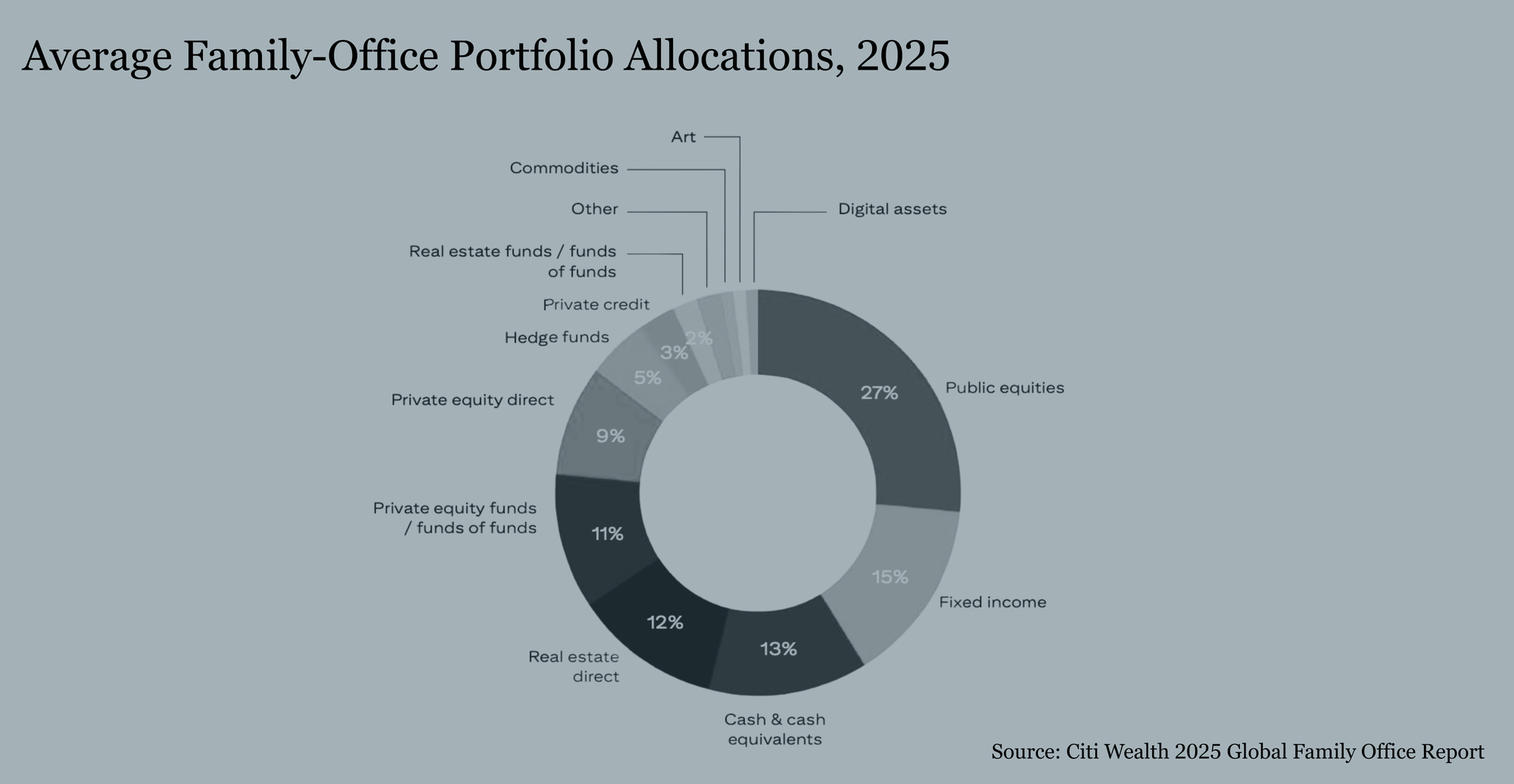

Family offices also remain committed to investing directly in companies. Out of all the offices, 70% said they made direct investments and 40% said they increased or significantly increased their activity in the past year. The average allocation to direct private-equity investments was 9% and the average allocation to direct real estate investments was 12%.

How successful family offices are at investing directly in companies and real estate is unknown. Citi’s report does not include details on how well certain asset classes or investment types perform within family-office portfolios. However, the Citi report notes that the size of their allocations to direct investments and increased activity suggest that family offices are confident in their ability to source good opportunities, manage those direct investments, and piece them together with the rest of their portfolio (something they are asking for more help doing, as portfolios have become more complex).

The average family’s net worth was $2.1 billion, but more than half the offices (53%) had less than $500 million in assets under their management.

Other findings in Citi’s report were akin to those from other surveys. Offices are most worried about things like rising tariffs and trade wars, the relationship between the U.S. and China, inflation and volatility. Citi also asked offices about their operations, personnel and other topics in its 50-plus question survey.

The bank surveyed a record 346 family offices this summer about their attitudes toward markets, investment management, operations and more to inform the 160-page report this year.

Respondents represented 45 countries across all regions, with 41% from North America, 29% from the Asia-Pacific region, 23% from Europe, the Middle East and Africa, and 7% from Latin America.

A CIO Begins His Defense

The former chief investment officer of a family office in Texas has begun a legal defense against his previous employer.

Michael Mann, the founder and CEO of Anchor Capital GP, a Dallas private-equity and investment advisory firm, and his company filed a response in a Texas state court on Monday to allegations made against them by Jean Christine Thompson and Thompson Petroleum Corporation, or TPC, the successful upstream company her family started that also serves as their family office.

In a complaint filed on August 19, Thompson and TPC alleged that Mann made investments without Thompson’s required approval, fraudulently overstated the value of his assets to secure a $15 million personal loan, and that his insulting remarks to colleagues during his short tenure were grounds for his termination earlier this year, Modus previously reported.

Mann joined TPC as its CIO in January and was fired from the family office in February.

He met Thompson years earlier. Before hiring him to be CIO of TPC, Thompson had invested $40 million in Anchor Capital funds.

According to court documents, the principal and office want the loan money paid back, damages related to Mann’s employment contract, and a declaratory judgment that TPC doesn’t owe Mann any carried interest on any future investment profits.

In Monday’s filing, Mann and Anchor denied the allegations and called the complaint an “unfounded smear campaign against a former business partner through a baseless lawsuit to bully them into capitulating to extortionist demands.”

According to the defendants, Thompson and TPC’s complaint knowingly misrepresented a loan that Thompson made to Anchor and that Mann guaranteed, not a personal loan to Mann.

“They do not allege Anchor failed to make required payments, cannot make such payments, or that any payments are even due under the loan; instead, TPC and Thompson claim they are entitled to immediate payment of the entire $15 million balance because they speculate that Mann — as a guarantor if Anchor failed to pay— may have slightly overstated his assets. Not only is this wholly untrue (which TPC and Thompson know), it cannot form the basis of their claims even if it [were],” the defense said in its court filing.

Mann and Anchor also said in their answer filed Monday that allegations related to Mann’s employment were “baseless,” that Thompson and several other employers approved the investments Mann recommended as CIO, and there was no reason for him to be terminated.

The defense added: “There is no question that TPC and Thompson lacked cause for Mann’s termination, thus entitling him to retain the benefits that fully vested upon his hiring. TPC and Thompson both know that they did not terminate Mann’s employment for cause and that they cannot seek to claw back Mann’s carry.”

In its response, the defense also pointed to what it characterized as Thompson’s history of backing out of deals and filing meritless lawsuits: A 2022 Forbes article that detailed Thompson’s effort to claw back $200 million in bonuses that she paid to two former employees (both cases were settled), and a public filing in May by Xerox that describes Thompson’s interest in terminating a commitment to purchase $225 million of unsecured notes.

“Mann’s business partners trust him for his candor, grit, and thoughtful approach. Unsurprisingly, he has never before been sued and looks forward to setting the record straight: Thompson and TPC’s allegations are baseless, false, and conjured to obtain leverage to keep Thompson from having to honor the commitments she made. Mann’s reputation and livelihood are simply collateral damage to Thompson,” the defendants stated in court documents.

The Modus newsletter is an unrivaled opportunity to advertise to family-office professionals alongside independent journalism they trust, and that informs their decisions. The performance speaks for itself:

• 1,500+ subscribers (300+ single-family offices, as well as hundreds of UHWN wealth managers, coverage groups at asset managers and investment banks, consultants, and other family-office professionals). This list grows every day.

• 60%+ unique open rate.

• 10%+ unique click rate.

• 4.5%+ unique click CTR on ads.

To inquire about advertising, email Michael Thrasher: michael.thrasher@modus.news

More News

- Arch, the alternative investments software used by over 180 single-family offices, announced yesterday that it raised $52 million in a Series B funding round led by Oak HC/FT. Modus interviewed Ryan Eisenman, co-founder and CEO, about the company’s product development and growth plans (family offices are more than one-third of its 450+ customers). Exclusive details here.

- T. Rowe Price Launches Blue Bond Fund Backed by Walmart Heir.

- The Allocator Training Institute has launched the Institutional Allocator (IA) credential. “If you’re looking to succeed in a career with a pension fund, endowment, foundation, sovereign wealth fund, family office, OCIO, or similar, this is the program that will help get you there,” Alex Ambroz, founder and CEO of the Allocator Training Institute, said.

- The Pritzker Organization (TPO) has formed a strategic partnership with Cleveland-based Wellspring Family Office, a multibillion-dollar private wealth manager for a short list of super-wealthy families. Capital invested in Wellspring will be used to improve various things: investment management, tax, trust services, banking and advisory relationships, and technology and operations.

Jobs

- One of the “top philanthropic families” in New York City is hiring a senior accountant. It’s a hybrid role, and the salary is $135,000.

- A family office in Dallas, Texas, is hiring an accountant. Salary is $80,000.

Other Stuff

- 1,600+ people follow Modus on LinkedIn.

- Almost no one follows Modus on X (yet). But I’m going to try to post there more.

- Documentation and other things (think court documents, corporate communication, etc.) make good tips. If you think something is newsworthy, or wish there was more to read about it, chances are that Modus and other readers do, too.

- To share information with me in confidence, you can also reply to this email or message me on Signal: +1 330-962-6441.

I'll be in...

- New York City.

- Chicago, the week of October 27, for IceMiller’s Family Office Private Capital Forum. If you work for a family office and would like to attend, apply here. If it’s full, you should still apply and get on the list for next year.