Programming note: Modus occasionally sends timely emails in addition to, or in place of, the regular Friday newsletter.

Preqin, the alternative assets data and analytics firm, published a blog post in July that identified positive signs for investment firms planning to fundraise this fall. The appetite for new private-market funds remained seemingly insatiable (since 2020, the number of funds in the market more than doubled to over 18,500), and the gap between net capital calls and net distributions was narrowing, the blog pointed out.

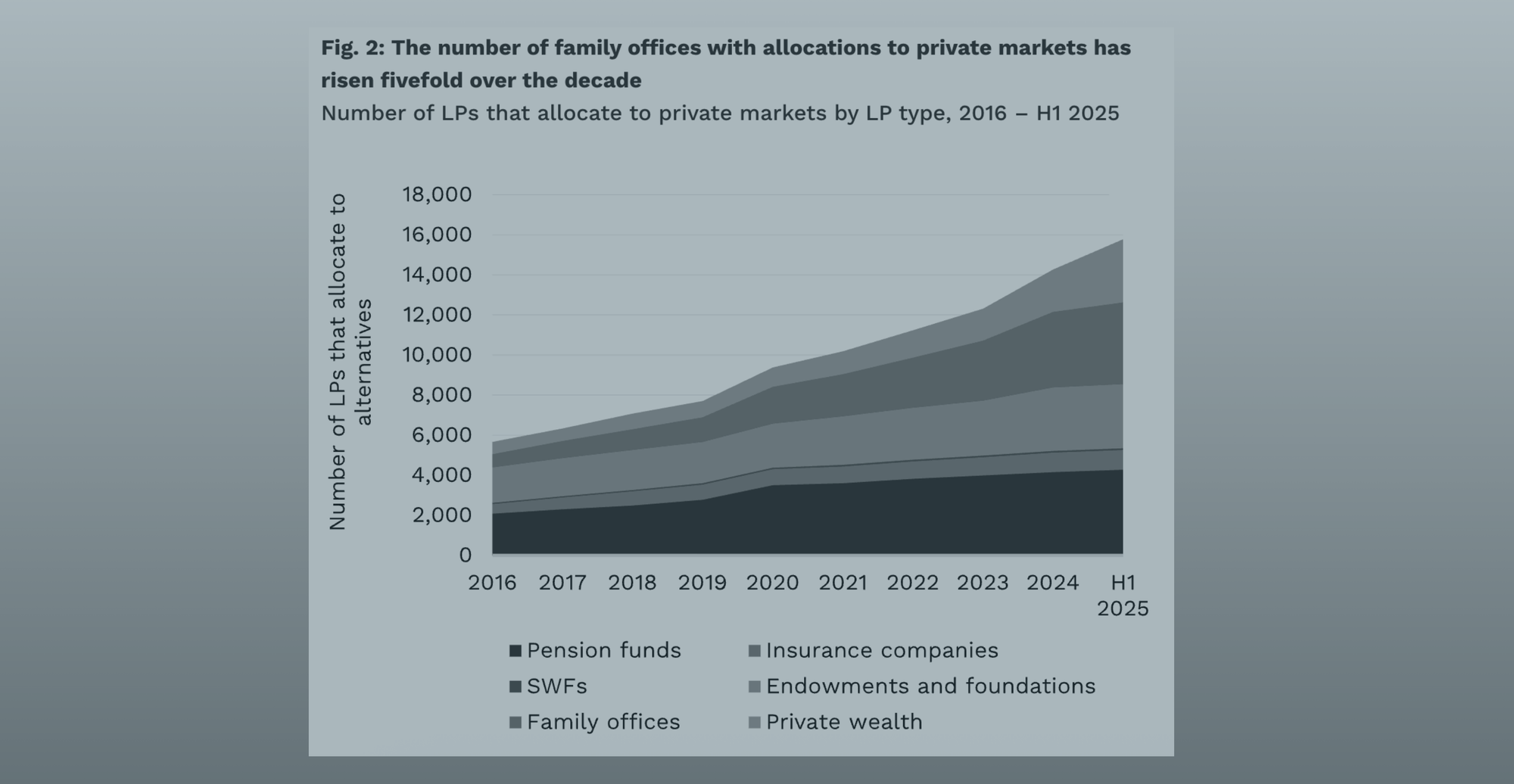

Something else asset managers could feel good about, according to the blog, was that many more family offices were investing in alternative investments, things like real estate, private equity, private credit, venture capital and infrastructure. Preqin’s research showed that from 2016 through June 2025, the number of family offices exposed to private markets grew from 651 to 4,067, or 524%, a significantly higher rate than other types of investors such as pension funds, insurance companies, wealth management firms, endowments and foundations.

The statistic did not go unnoticed. Last month, family offices were suddenly reported to be doubling down and loading up on alternative assets, and charts visualizing the exposures circulated on social media with proclamations about the causes and impact.

Many more family offices have exposure to private markets, as Preqin tallied, and most of the things written about that are technically correct. But the 524% doesn’t accurately reflect how family offices are investing. The average chunk of their portfolio invested in alternatives has actually shrunk.

The rise in the number of family offices exposed to private markets is primarily a result of the proliferation of family offices. From 2019 to 2024, Deloitte estimates the number of offices globally grew 31% from 6,130 to 8,030 and it projects there will be over 9,000 in 2025. Most of those offices are invested in alts, or are newly established and they will be soon. A different Preqin survey early last year found that 66% of family offices said they had exposure to alternative investments, 8% had no exposure, and 26% didn’t respond to that question.

Family offices have been longtime investors in alternatives, and they have allocated roughly half of their portfolios to those asset classes, reports by UBS, BlackRock and others have shown. Allocations to alternatives at U.S. family offices fell by only one percentage point, from 47% ot 46%, which could be partly attributed to the rising value of public equities swelling that slice portfolios.

Goldman's report this year is the most robust version of it yet, with 245 family offices compared to 166 in 2023. The sample size is big, but the respondents are among the richest, with 67% having a net worth of at least $1 billion. On average, 70% of their investment needs are managed in-house. Roughly half of the offices are in the Americas, a quarter are from EMEA and a quarter are from the APAC region.

“It's really not changing. This is a client base that's very committed to alternatives. I think there are a lot of reasons for that,” Sara Naison-Tarajano, global head of the Apex group and private wealth management capital markets at Goldman Sachs, told Modus. A big reason is “when you get to a certain wealth level, there's only so much liquidity you really need, right?”

Despite ongoing geopolitical conflicts, inflation fears and more, it’s still “risk-on” right now at family offices, and there’s a lot of evidence in portfolios to prove it, Naison-Tarajano explained.

The average fixed income allocation was 11%, one percentage point higher than two years ago. But the durations look very different. In 2023, just 39% of their bonds have an average duration of three to five years. Now, 57% do, meaning that offices expect interest rates to be lower in the near future — and that stocks will go up.

“I think these family offices were very, very strategic about getting in front of the idea, which is now consensus, of rates being cut. They really started to move out the duration of their fixed income portfolios in a really smart way…even if it meant taking slightly less yield. And that's absolutely been the right trade,” Naison-Tarajano said.

More than a third of offices are also planning to increase allocations to public equities (right now 31% of portfolios on average) and reduce cash balances and redeploy capital into risk assets (12% of portfolios).

Thirty-nine percent of family offices expect to invest more in private equity but at their current steady pace; a programmatic way of investing to ensure exposure to different vintages. Naison-Tarajano said Goldman is helping more offices with asset aging and capital call planning.

All those things are evidence that family offices are becoming more sophisticated. Like institutional investors, they are thinking harder about what they can and should do internally or outsource, seeking professionals with backgrounds in asset management to hire and, consequently, engaging differently with partners.

“I am now doing three to five pitches a week [compared to an occasional one] with investment banking to talk about the unique edge that we have around family-office capital... that is a distinct change,” Naison-Tarajano said. “That is really meaningful and kind of represents the increase in sophistication on one part, but also the increased importance of this community to the overall capital markets.”

To preserve wealth and purchasing power, portfolios must outperform inflation net of fees and taxes. U.S. public equities have been the best asset class for that job, but as more companies stay private longer, investors don’t want to miss out on upside, want to smooth volatility, and they have turned increasingly to alternative investments.

In 2025, private equity allocations fell to 21% from 26% in 2023. Within that allocation, buyout accounted for 9%, growth 6% and venture 6%.

Allocations to private real estate and infrastructure rose 2 percentage points to 11%. Private credit was up to 4% from 3%. Hedge-fund allocations held steady at 6%. Offices also had 1% invested in commodities again this year.

“The only way for a family office, and really anyone wanting to grow their wealth over time, is to beat that inflation. It's very telling that, despite where the equity markets are, we still see family offices committing to continuing to invest. I think that's kind of the most interesting takeaway, in my opinion.”

More News

- The Murdoch family battle over their media empire — one dramatic enough that it inspired HBO’s “Succession” — came to an end Monday. In an agreement, Lachlan Murdoch will secure control of the two main companies, Fox Corporation and News Corp., and his three oldest siblings will receive $1.1 billion each for all their shares in the empire. The new trust, which will hold shares of the businesses, expires in 2050. Those details and more are in an analysis by The New York Times, which has dominated coverage of this story in recent years. Morgan Stanley is handling the block trade, and institutional investors, sovereign wealth funds and large family offices are lined up to buy stakes, according to the FT.

- Fewer than 1,000 ultrawealthy investors have contributed more than a third of the capital raised by 200 startups and nonprofits involving aging and longevity, $5 billion of the $12.5 billion. Among those private investors, a shorter list of billionaires has accounted for a significant part of the money raised, according to an analysis by The Wall Street Journal.

- High tariffs have, of course, helped smugglers. But before you wrap both of your forearms with Swiss watches, or cram a few extra coats and purses into your luggage, consider the risk-reward and read this Bloomberg story, a history of avoiding duties.

Jobs

- The Cox Family Office, which serves the family that still owns and runs the Cox Enterprises conglomerate, is hiring a family office tax analyst intern for the summer of 2026. Internships are a rarity at family offices; this person would get uncommon hands-on experience in tax compliance and planning for high-net-worth individuals, trusts, and related entities. A candidate must be a student and the job pays up to $32.26 per hour.

- A small but well-established family office based in New York is hiring an executive assistant. It pays a $105,000 salary, a “generous” bonus, and this person only has to go to the office two days per week.

- Northern Trust, which earlier this year created a family office solutions group and broke down walls within the organization to better service clients, is considering candidates for a lead director role in the solutions group.

- Aleta, the investment reporting software company, is looking for an investment controller to join it in New York.

Other Stuff

- Follow Modus on LinkedIn (1,500+ people already do).

- What makes a good news tip? Documentation and other things. You can reply to this email and share information with me in confidence, or message me on Signal using a personal device that is not accessible by your employer.

I'll be in...

- N.Y.C. for a few weeks.

- Chicago, the week of October 27, to attend law firm IceMiller’s Family Office Private Capital Forum. If you have or work for a single-family office and want to attend, apply here.

Clarifications on September 11, 2025: Some paragraphs in the version of this newsletter were edited to improve their clarity.